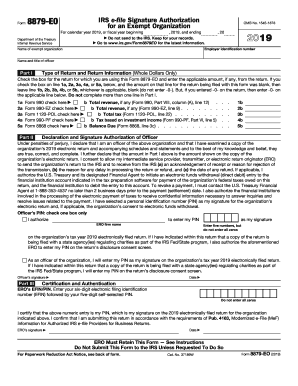

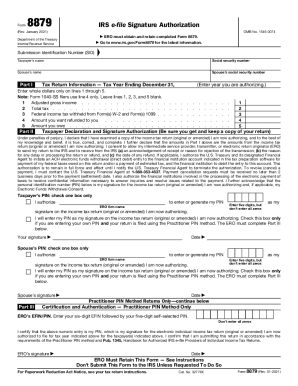

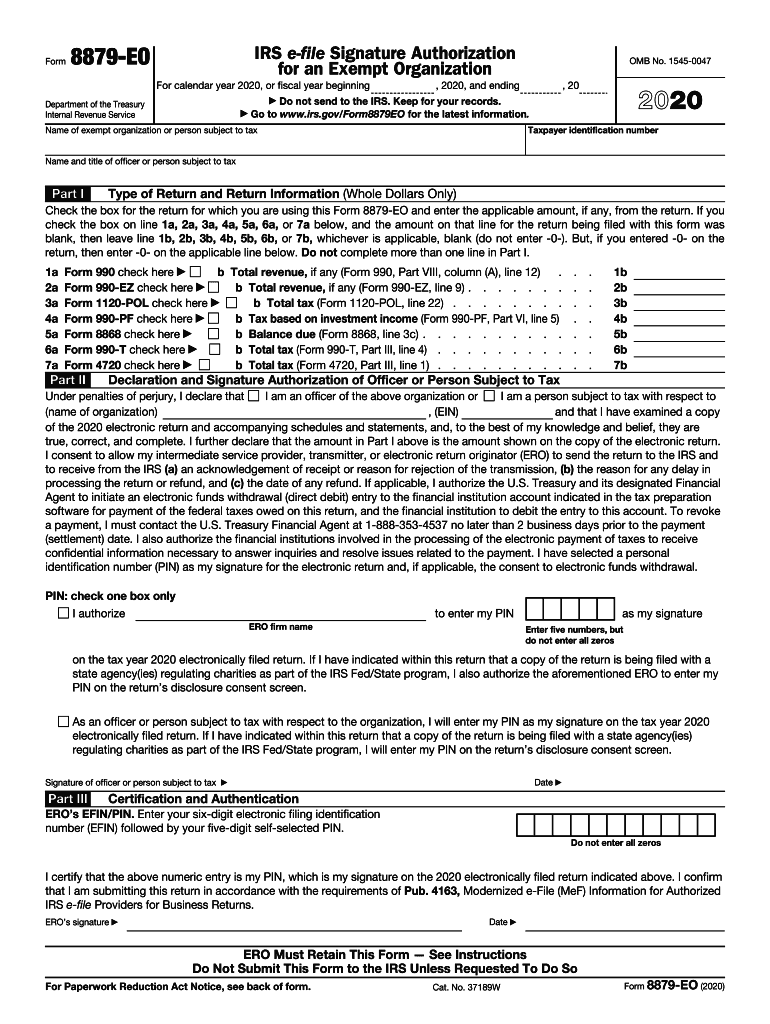

IRS 8879-EO 2020-2026 free printable template

Instructions and Help about IRS 8879-EO

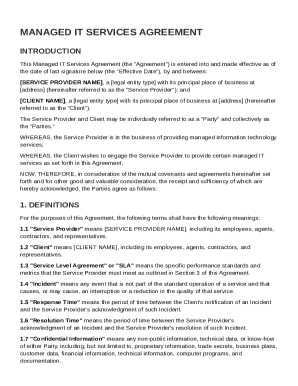

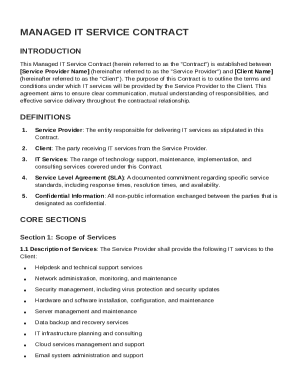

How to edit IRS 8879-EO

How to fill out IRS 8879-EO

Latest updates to IRS 8879-EO

All You Need to Know About IRS 8879-EO

What is IRS 8879-EO?

Who needs the form?

What are the penalties for not issuing the form?

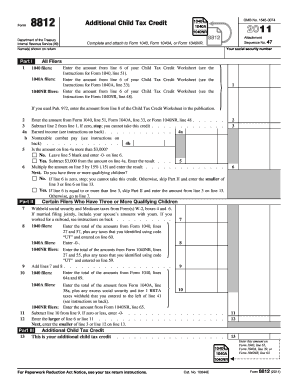

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8879-EO

What should I do if I need to correct an error on my IRS 8879-EO?

If you’ve made an error on your IRS 8879-EO after submission, you should first identify the type of mistake. Depending on the nature of the error, you may need to file an amended return or submit a request for correction. Always ensure to keep documentation of your original submission and the corrected information for your records.

How can I track the status of my IRS 8879-EO submission?

To verify the receipt and processing of your IRS 8879-EO, you can use the IRS's online tracking tools or contact their help line. Be aware of common e-file rejection codes, as these may require additional steps to rectify. Maintaining accurate records will help facilitate this process.

What privacy measures should I consider when filing IRS 8879-EO electronically?

When e-filing your IRS 8879-EO, ensure that you're using secure and reputable software that complies with IRS standards. Protect your personal and financial data by using strong passwords and ensuring that your device has updated security software. Retain all filing records safely to prevent unauthorized access.

What are the common errors that can occur when filing IRS 8879-EO?

Common errors when filing IRS 8879-EO include providing incorrect taxpayer information, failing to use proper e-signature methods, and neglecting to verify the eligibility of e-filing tips. To avoid these issues, double-check all entries and consult the IRS guidelines or software instructions for e-filing prior to submission.

What should I do if I receive a notice from the IRS after submitting my 8879-EO?

If you receive a notice from the IRS regarding your IRS 8879-EO, carefully read the communication to understand the issue. Gather supporting documents and consult any instructions provided in the notice. Respond promptly and accurately to prevent delays in processing your return.

See what our users say