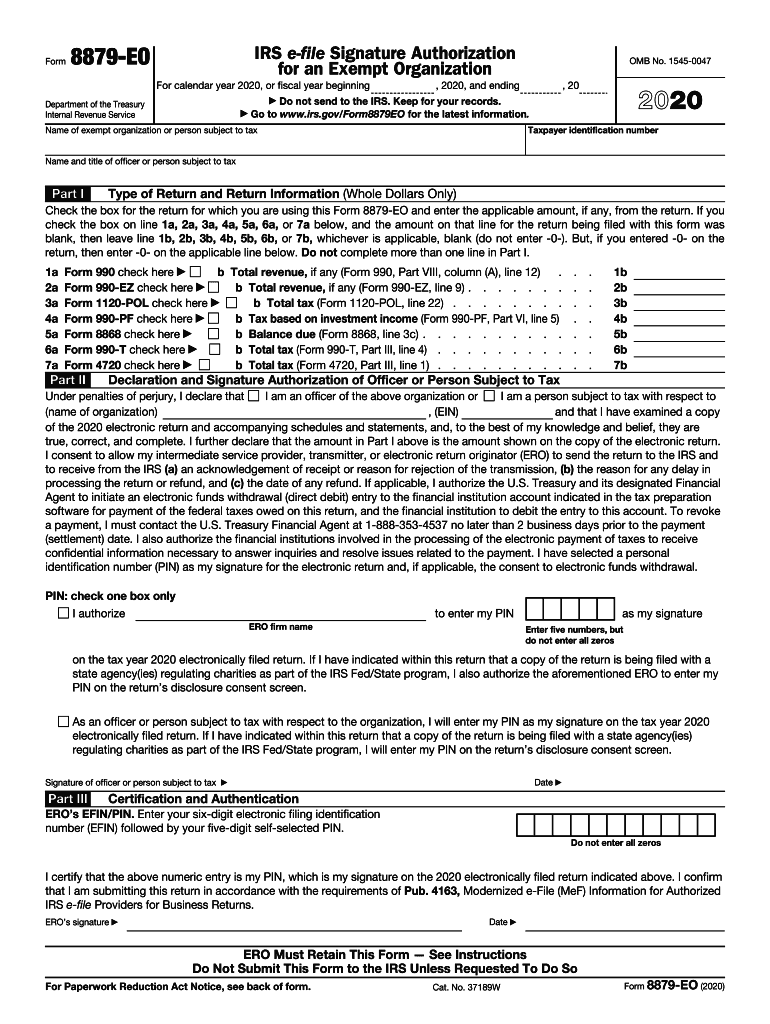

Who needs IRS Form 8879- EO?

IRS form 8879-EO is the IRS e-file Signature Authorization for an Exempt Organization. This document must be completed by the organization officer and electronic return originator. The latter is usually an accountant or a tax preparer who is authorized by the IRS and US government to help people and businesses to submit their tax returns electronically.

What is IRS Form 8879- EO for?

The form is designed for two main purposes. First, it serves to use a personal identification number to put an electronic signature on an organization’s electronic return. Secondly, it is used to authorize withdrawal of electronic funds.

Is IRS Form 8879- EO accompanied by other forms?

IRS Form 8879-EO is completed and kept for the records thus no documents must be attached to it.

When is IRS Form 8879- EO due?

There is no particular due date for the form. However, it must be kept for three years from the moment a tax return has been filed to the IRS. In the same way it can be retained if need be.

How do I fill out IRS Form 8879- EO?

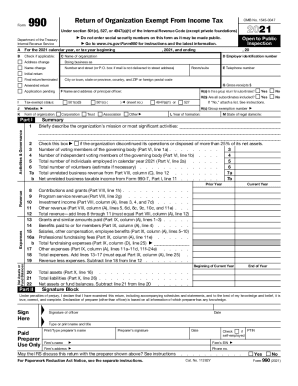

Form 8879-EO isn’t difficult to fill out. There is only one page and three parts that must be completed.

- Part 1 accounts for the type of the return for which Form 8879-EO is used. Simply check the appropriate boxes

- Part 2 is for the officer’s name and contact information

- Part 3 is for the ERO’s PIN

Where do I send IRS Form 8879- EO?

The form mustn’t be submitted to the IRS unless it is requested. See the latest information about the form on the IRS website.